STOP GUESSING. START STRUCTURING.

Master the Most Elusive Trades in the Market: Deep Dive Calendars & Diagonals

Most traders struggle with Calendars and Diagonals...

Most traders struggle with Calendars and Diagonals because they don't behave like standard vertical spreads or butterflies. While a typical P&L diagram for a butterfly stays put, these time spreads are dynamic—moving and shifting in ways that standard modeling fails to capture.

In this eight-hour deep dive, I break down the engineering behind these "elusive" trades. You won’t just learn what to trade; you’ll learn the professional-grade logic of why these systems work and how to manage them when the market moves.

In this advanced strategy course, you'll master:

-

Time Spread Mechanics: The fundamental structure of calendar and diagonal spreads and why they excel during volatility events.

-

Volatility Harvesting: How to strategically position before earnings to capture predictable volatility contraction.

-

Strategic Entry Timing: Precise guidelines for where to establish positions for maximum profit potential.

-

Diagonal Spread Construction: Advanced techniques for creating positive theta positions with directional bias.

-

Risk Containment Systems: Methods to define and limit risk while maximizing profit potential.

-

Adjustment Frameworks: Step-by-step protocols for managing trades when markets move against your position.

THE OIA PHILOSOPHY

Professional-Grade Reasoning

Options Income Academy (OIA) exists for one purpose: To turn committed traders into self-reliant strategists. I lead a precision-driven platform built for those who want to graduate from signal-chasing to professional-level strategy.

- Risk is engineered: You don’t guess; you structure.

- Strategy > Prediction: I trade with positioning logic, not crystal balls.

- Probabilities drive decisions: Trading is math and structure—not emotion.

Prerequisites for Success: Build on a Solid Foundation

To execute these strategies with the precision they require, you need a working command of the Greeks, multi-leg mechanics, and risk management.

My goal isn't for you to simply follow instructions; I want you to understand the engineering behind every trade .

If you are new to options or "the Greeks" still feel like a foreign language, do not start here. You would be building on a shaky foundation.

Instead, choose the path that matches your current experience level:

For the Fundamental Learner

If you are still building those fundamentals, we want to set you up for success, not frustration. Start with our Options Trading for Beginners course. This will ensure you master the mechanics and terminology first, so you can approach advanced strategies with confidence later.

For the Experienced Trader

If you are already comfortable with Delta, Theta, and multi-leg structures, you are ready to refine your edge. Proceed with the Calendars & Diagonals module.

For the Committed Strategist

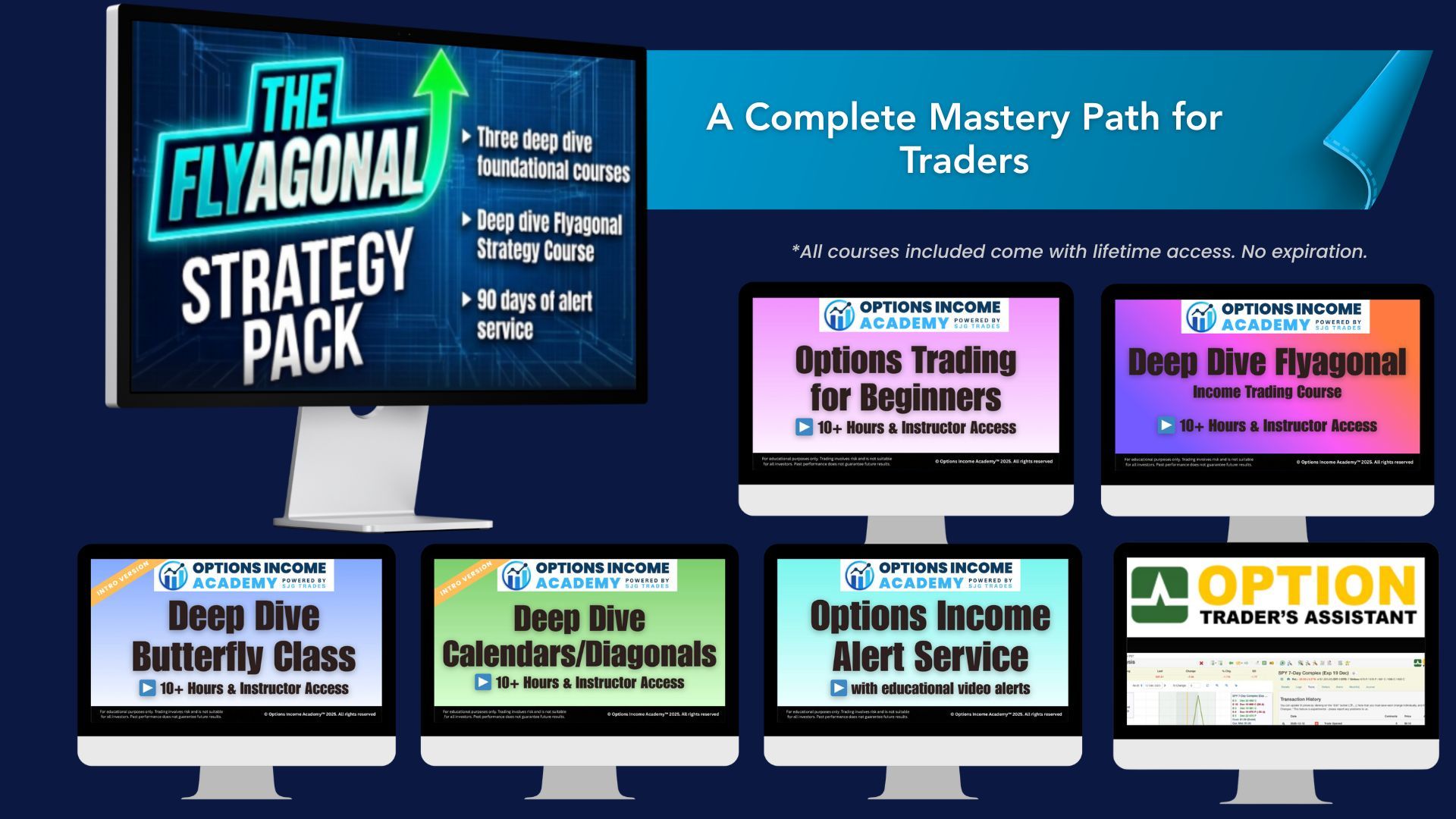

If your goal is to master the Flyagonal methodology—the highest performing, most consistently profitable strategy I trade—we recommend the Flyagonal Strategy Pack.

This "PhD-level" bundle includes:

- All Education Modules: Beginners, Calendars/Diagonals, and the Flyagonal Deep Dive.

- The Tools: 90 Days of access to the Alert Service ecosystem.

- The Tech: A 90 Days of the Option Traders Assistant (OTA) software to streamline your execution.

MEET YOUR INSTRUCTOR

Steve Ganz

Master the fundamentals that 90% of options traders never learn – and position yourself for consistent, strategic success.

Steve Ganz brings over three decades of hands-on experience in the trading industry, having immersed himself in stocks, commodities, futures, indexes, and options alike. An adept educator, Steve has led live trading sessions and shared his insights on platforms like Aeromir, OptionAlpha, and OptionStrat.

Through Options Income Academy, Steve extends his commitment to quality trading education, aspiring to build a community where traders grow in skill and confidence.

Explore Options Income Academy and tap into the wealth of knowledge Steve offers, ensuring every trader feels both supported and empowered.

"I wanted to reach out and express my sincere appreciation for the calendar course you've offered. It's undeniably one of the most outstanding training programs I've ever come across. I hold you in high esteem for your expertise and the invaluable knowledge you've shared. In particular, I've gained a profound understanding from the trades that didn't go as planned.

Learning how to navigate the ups and downs (and actually avoid seasawing), such as the intricate maneuvering of options on each leg, is a level of insight that I haven't encountered elsewhere. It's in these challenging moments that one learns the most.

I am very glad to have the opportunity to learn from you, and I'm committed to continuing my education through your guidance. Once again, I extend my heartfelt thanks for your dedication and exceptional teaching."

– Martin V., Options Trader

"For anyone serious about mastering income-generating option strategies, the Options Income Academy is second to none. After completing two Deep Dive courses, I was amazed by how immediately actionable the material was. Coach Steve Ganz breaks down complex Butterfly and Calendar trades into clear, step-by-step lessons, explaining not just how to place each trade but why every strike, expiration and adjustment makes sense."

— Jens (J.K., Switzerland)

"I also purchased his butterfly and calendar classes and those contain heaps of information and techniques. I thought that I knew everything I needed to know about butterflies until I took his course. To this day I'm still using his techniques in my everyday trading and it's made a huge difference."

– Chris M., Options Trader

Your Investment:

$995

Full course (10+ hours of training)

Ready to Master This Strategy?

Unlock the strategies and insights to elevate your options trading game. With "Deep Dive Calendars and Diagonals," position yourself at the forefront of trading excellence.

YES, I AM READY!